Take Advantage of these Tax Credits Next Year

The Inflation Reduction Act (IRA) was passed in August 2022 to tackle the national debt, healthcare costs, and energy security. This post focuses on Subtitle D, the Energy Security portion. If you are a homeowner looking to make improvements or if you are considering purchasing an electric vehicle (EV), review the opportunities available to you to reduce your tax bill.

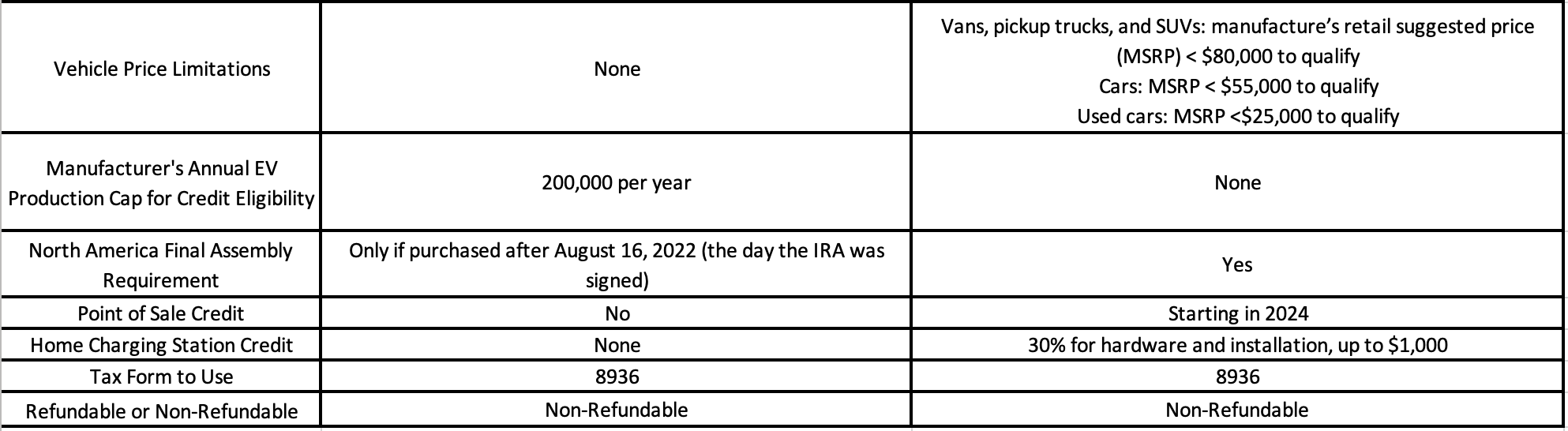

This table can be a starting point, but be sure to check with your state and utility company for additional benefits. Keep good records, and touch base with your financial and tax professionals to make sure you are clear on how to best maximize your tax credits next year.

Linda Rogers, CFP®, EA, MSBA is the owner and founder of Planning Within Reach, LLC (PWR). Originally from New Jersey, Linda services clients nationwide and is based in San Diego. She leads the design of PWR's investment portfolios which utilize broad, low-cost investments that integrate environmentally, socially, and governance (ESG) factors.

Planning Within Reach, LLC (PWR) is a virtual fee-only and fiduciary wealth management firm offering one-time comprehensive financial planning and ongoing impact-focused investment management. PWR is a woman-owned firm that specializes in busy professionals and impact investors. Planning Within Reach, LLC and its advisors do not receive commissions and do not hold any insurance licenses or brokerage relationships.